How to Register a Company in Pakistan: A Legal Guide for Entrepreneurs : Starting a company in Pakistan can be an exciting venture, but navigating the legal procedures can seem daunting. This comprehensive guide will walk you through the steps to register a company in Pakistan, answer common questions, and provide resources to ensure a seamless process. Whether you’re a first-time entrepreneur or an experienced business owner, this guide will equip you with the knowledge to kickstart your business successfully. we will walk you through the step-by-step process of registering a company in Pakistan, ensuring that you have a clear understanding of the legal requirements and procedures.

Why Registering Your Company Matters

Registering your company in Pakistan provides legal recognition, builds credibility, and protects your business identity. It also opens doors to benefits such as easier access to funding, trademark protection, and the ability to enforce contracts. With platforms like Pakistan Law Bot and its AI-driven legal chatbot, entrepreneurs now have access to quick, accurate legal advice at their fingertips. Registering a company in Pakistan is a significant step that requires careful planning and adherence to legal procedures.

Steps to Register a Company in Pakistan

1. Choose a Business Structure

The first step in registering a company in Pakistan is to choose the appropriate business structure. The type of business structure you select will determine your legal obligations, liability, and tax implications. Common business structures in Pakistan include:

- Sole Proprietorship: A business owned and operated by one individual.

- Partnership: A business owned and operated by two or more individuals.

- Private Limited Company: A company with limited liability, where shares are not publicly traded.

- Public Limited Company: A company with limited liability, where shares are publicly traded.

- Limited Liability Partnership (LLP): A hybrid structure that combines elements of a partnership and a limited company.

Each structure has its own set of requirements and regulations. For instance, a Private Limited Company requires a minimum of two shareholders and two directors, while a Sole Proprietorship requires only one owner.

| Business Structure | Features |

|---|---|

| Sole Proprietorship | Owned by one person, simple setup, limited liability |

| Partnership | Shared ownership, governed by a partnership agreement |

| Private Limited Company (Pvt Ltd) | Separate legal entity, limited liability, suitable for medium to large businesses |

| Public Limited Company | Allows public shareholding, complex setup |

| Non-Profit Organization (NPO) | Dedicated to charitable or social purposes |

Each structure has its advantages and legal obligations. Most entrepreneurs opt for a Private Limited Company due to its limited liability and ease of raising funds.

…………………………………………..

SECP registers over 27,000 new companies in FY2023-24

2. Reserve a Company Name

Before registering your company, it’s essential to ensure that the name you’ve chosen is not already in use. You can do this by conducting a name search through the Pakistan Companies Registry (PCR) or by using online platforms like Pakistan Law Bot, which offers AI-powered legal assistance. Your company name must comply with the guidelines of the Securities and Exchange Commission of Pakistan (SECP). Ensure that the name:

- Is unique and not similar to an existing company.

- Does not include prohibited terms like “government” or “federal.”

- Reflects your business activity.

| Business Structure | Liability | Ownership | Registration Requirements |

|---|---|---|---|

| Sole Proprietorship | Unlimited | One individual | Simple, minimal paperwork |

| Partnership | Unlimited | Two or more individuals | Partnership deed required |

| Private Limited Company | Limited | Two or more shareholders | Detailed registration process |

| Public Limited Company | Limited | Shares publicly traded | Extensive regulatory requirements |

| Limited Liability Partnership (LLP) | Limited | Two or more partners | Combination of partnership and company laws |

- Your company name must be unique and comply with the SECP’s naming guidelines.

- Avoid prohibited or sensitive words.

- Check the availability of your chosen name using SECP’s Company Name Search tool.

You can check name availability on the SECP website. SECP’s online portal also allows you to reserve the name for your company.

3. Prepare Required Documents

Depending on the nature of your business, you may need to obtain specific approvals or licenses from relevant authorities. For example, if you’re operating in a sector that requires environmental clearance, you’ll need to obtain the necessary permits from the Environmental Protection Agency (EPA). You will need the following documents to register your company:

- Memorandum of Association (MOA): Defines the company’s objectives.

- Articles of Association (AOA): Specifies the rules for running the company.

- CNIC Copies of Directors/Shareholders

- NTN Copies of Directors (if available)

- Address and Contact Information

- Proof of Registered Office Address

SECP provides templates for MoA and AoA to simplify the process.

4. File Your Application with SECP, Draft the Memorandum of Association (MOA) and Articles of Association (AOA)

For a Private Limited Company, you need to draft the Memorandum of Association (MOA) and Articles of Association (AOA). The MOA outlines the company’s objectives and liabilities, while the AOA details the company’s internal management structure. The SECP offers an online registration portal for company incorporation. Follow these steps:

- Create an account on the SECP eServices portal.

- Fill out the Incorporation Form (Form 1).

- Attach required documents, including the reserved name certificate.

- Pay the registration fee online.

Once submitted, SECP reviews your application. The process typically takes 3-5 working days.

5. Submit the Registration Application, and Obtain NTN and Register for Taxes

Once you have all the necessary documents, you can submit your registration application to the Pakistan Companies Registry (PCR). The application can be submitted online through the PCR’s official website or in person at the registry office. After your company is incorporated, you must:

- Apply for a National Tax Number (NTN) from the Federal Board of Revenue (FBR).

- Register for Sales Tax if applicable.

- File monthly and annual tax returns.

Tax compliance is crucial, and you can use platforms like Pakistanlawsite.com to understand tax laws better.

6. Pay the Registration Fees and Open a Corporate Bank Account

Registration fees vary depending on the type of company and the authorized capital. Ensure that you pay the required fees as part of the registration process. Once your company is registered, open a corporate bank account in the company’s name. Provide your:

- Certificate of Incorporation

- NTN

- MoA and AoA

- Directors’ CNICs

7. Comply with Regulatory Requirements and Obtain the Certificate of Incorporation

Upon successful registration, you will receive the Certificate of Incorporation, which legally establishes your company in Pakistan. Depending on your business sector, you may need additional licenses or permits. For instance:

- Exporters/Importers: Require an Export/Import License.

- Food Businesses: Need a Food Authority License.

Stay updated on legal requirements with the Pakistan Law Bot.

Important Considerations

- Legal Compliance: Ensure that your business complies with all relevant laws and regulations, including tax laws, labor laws, and industry-specific regulations.

- Tax Registration: Obtain a National Tax Number (NTN) and register for sales tax if applicable.

- Trademark Registration: Protect your brand by registering your trademarks with the Pakistan Trademark Office.

| Expense | Estimated Cost (PKR) |

| Name Reservation Fee | 1,000 – 2,000 |

| SECP Incorporation Fee | 10,000 – 15,000 |

| NTN Application Fee | Free |

| Corporate Bank Account Setup | Varies by bank |

| Additional Licensing Fees | Varies by industry |

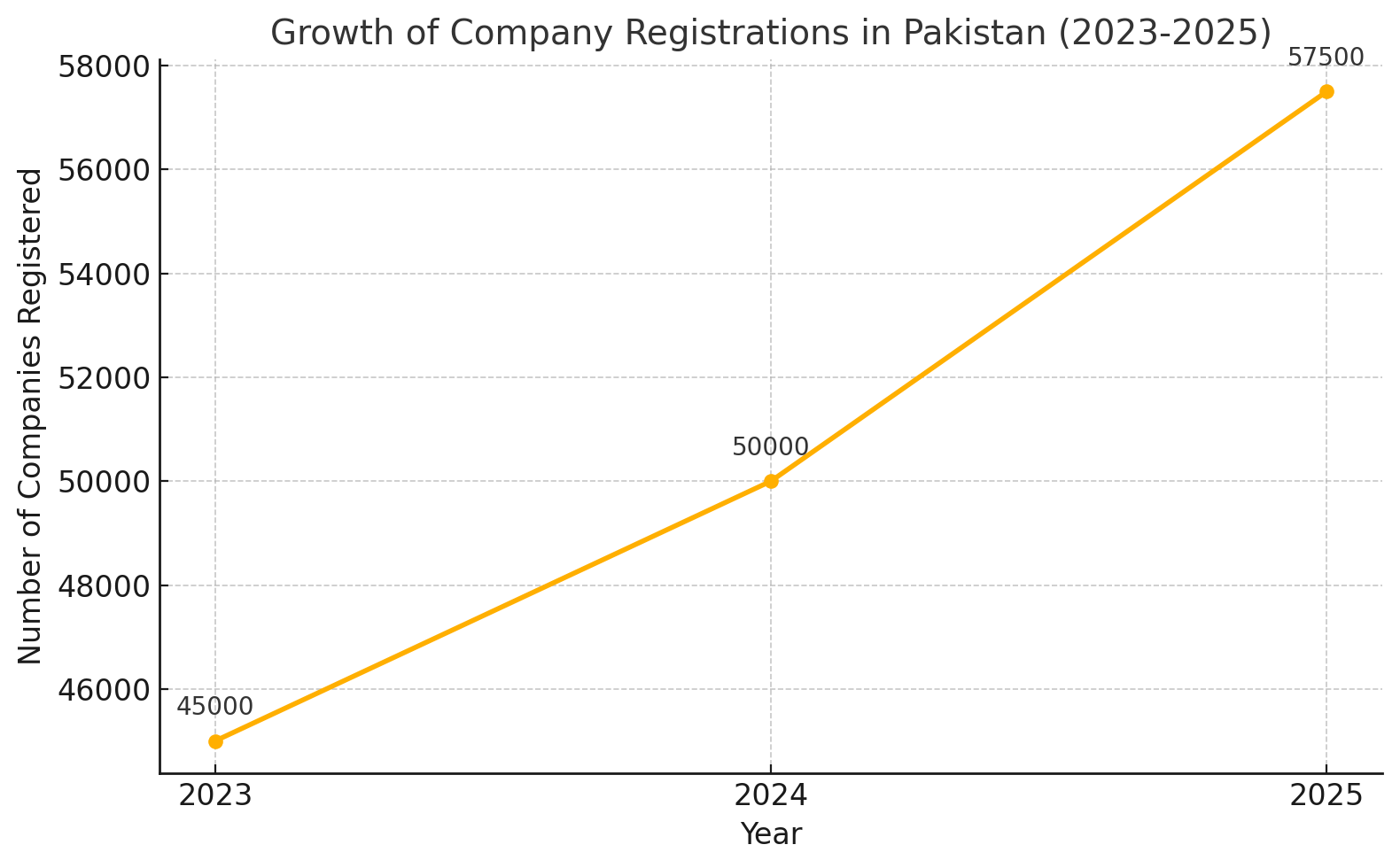

In 2024, over 50,000 new companies were registered in Pakistan, reflecting a 12% increase from the previous year. By 2025, this trend is expected to grow by another 15%, driven by:

- Increasing awareness of legal compliance.

- Growth in e-commerce and tech startups.

- Simplified online registration processes.

Common Challenges and How to Overcome Them

1. Understanding Legal Jargon

Many entrepreneurs find it difficult to navigate complex legal terms. Pakistan Law Bot simplifies this by providing clear, AI-driven explanations of legal procedures.

2. Complying with Tax Laws

Taxation in Pakistan can be overwhelming. Using an AI legal chatbot or consulting Pakistanlawsite.com can clarify tax requirements and deadlines.

3. Obtaining Approvals and Licenses

Government bureaucracy can delay processes. Early preparation of documents and using SECP’s online portal minimizes delays.

FAQs About Registering a Company in Pakistan

1. Can a foreigner register a company in Pakistan?

Yes, foreigners can register a company in Pakistan. They need to:

- Have a Pakistani partner or representative.

- Obtain a business visa.

- Follow the same SECP registration process.

2. How long does it take to register a company?

The process takes 3-5 working days, provided all documents are in order.

3. Can I register a company without a physical office?

Yes, but you need to provide a mailing address for correspondence.

4. How much capital is required to start a company?

There is no minimum capital requirement for most business structures. However, Public Limited Companies have specific capital requirements.

Tools and Resources for Entrepreneurs

- Pakistan Law Bot: AI-driven legal assistant for quick legal advice.

- Pakistanlawsite.com: Comprehensive legal database for Pakistan.

- SECP Portal: For company incorporation and compliance.

The Role of AI in Legal Assistance

In today’s digital age, AI-powered legal assistants like Pakistan Law Bot are revolutionizing the way businesses navigate legal processes. These AI chatbots provide instant legal advice, helping entrepreneurs understand the complexities of company registration and other legal matters.

Conclusion

Registering a company in Pakistan is a straightforward process when you understand the legal requirements. By leveraging resources like the Pakistan Law Bot, entrepreneurs can save time and focus on growing their businesses. Whether you’re launching a tech startup or opening a retail store, this guide has you covered.

For more insights on legal processes, check out our blogs:

- How AI is Revolutionizing Legal Assistance in Pakistan

- How to File a Lawsuit in Pakistan: A Step-by-Step Guide

- How to Handle Property Disputes in Pakistan

Final Thoughts

As you embark on your entrepreneurial journey in Pakistan, remember that a well-structured and legally compliant business setup is the foundation of long-term success. With the right guidance and tools, you can navigate the legal landscape with confidence, focusing on what you do best—building your business.